Baker Botts was proud once again to partner with Rice University’s Baker Institute Center for Energy Studies (CES) for the 9th Annual Energy Summit, held October 7–8 in Houston. This year’s theme — “Resilience in Energy Supply Chains” — explored the complex trade-offs defining the future of global energy systems and the balance between innovation, markets, and policy in ensuring long-term reliability and growth.

Day One — A Timely Focus on Resilience

View the recording here.

In opening remarks, Ambassador David Satterfield and Danny David, Baker Botts Managing Partner, framed the summit as a dialogue between the worlds of policy and practice — where academic insight meets commercial reality. The message was clear: resilience is no longer just about redundancy, but about adaptability, diversity, and foresight across global energy systems.

Dr. Ken Medlock’s opening address connected the dots between supply-chain resilience, profitability, and energy security, setting the stage for two days of rigorous discussion that blended macroeconomics, geopolitics, technology, and investment.

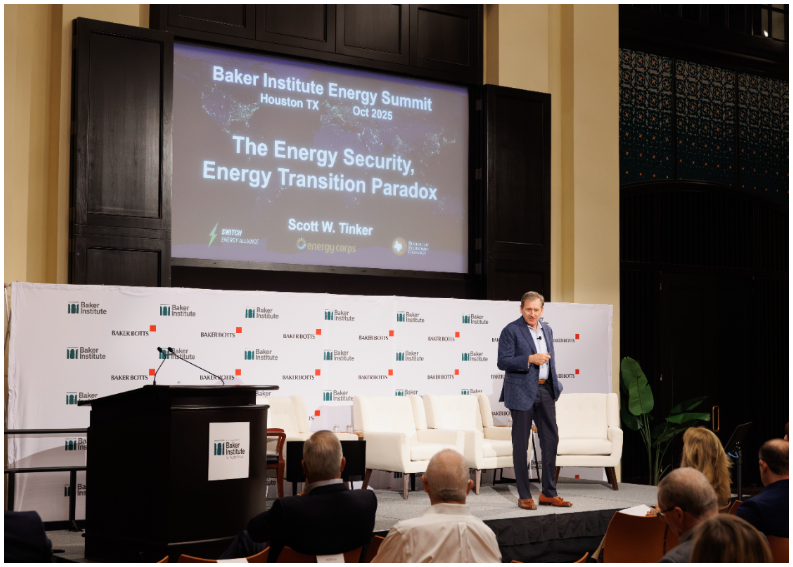

Dr. Scott Tinker delivered an energizing talk on the interplay between clean, reliable, and affordable energy, urging balance among the three to avoid policy paralysis. As he put it, focusing on “clean” alone risks stalling real decarbonization progress.

Ryan Sweet of Oxford Economics gave a fantastic presentation on the macro environment, especially in the U.S., with a few key takeaways: the potential for AI to cause a long jobs transition and the threats around a tech/AI bubble may be overblown at this moment, but they are both concerning and worth keeping an eye on; his wisdom on trade and tariffs gave important context for how economic policy directly affects supply chains and investment decisions, and; he confidently reassured us that the risk of the U.S. entering a recession in the next 12 months is low.

Global Perspectives on Energy Security

The “Around the World in 60 Minutes” panel, moderated by Baker Botts Partner Mark Castillo-Bernaus, provided an extraordinary sweep of global viewpoints:

Gabe Collins and Dr. Francisco Monaldi examined how China’s energy transition and Latin America’s upstream growth could reshape global LNG and investment flows.

Todd Moss spotlighted Africa’s electrification efforts and nuclear financing opportunities, while Jim Krane offered a nuanced view of Middle Eastern energy investment priorities.

As Collins noted memorably, “Nuclear is the protein for an energy diet.”

Baker Botts Partner Scott Janoe moderated a session with Dr. Michał Kurtyka (former Polish Climate Minister) who reminded attendees that “Europe is not a monolith,” describing divergent approaches to energy diversification. Energy Transition — in Transition

Energy Transition — in Transition

The Energy Transition in Transition panel brought together leaders from ExxonMobil, Saudi Aramco, Copenhagen Infrastructure Partners, and Honeywell UOP, moderated by Ted Loch-Temzelides. The conversation centered on the need for policy consistency, demand-side support, and credible pricing signals to mobilize long-term investment.

Baker Botts’ takeaway: policy certainty drives capital formation. Decarbonization must be sustainable, not just subsidized — and must extend beyond OECD borders to make a global impact.

Policy, Trade & Technology

In the afternoon’s Policy, Trade, and Resilient Supply Chains session, Baker Botts Partner Ted Posner moderated a session with a panel that included Tony White, Paul Perea, and Ashley Zumwalt-Forbes that dissected how tariffs, trade measures, and government financing have reshaped industrial competition with China. Despite bipartisan support for reshoring and near-shoring, panelists noted that inconsistent policy frameworks continue to deter investment in critical minerals and manufacturing.

The day closed with a forward-looking session on AI, electricity demand, and the role of nuclear power, moderated by Gabe Collins, featuring AWS’s Vibhu Kaushik and former Texas PUC Commissioner Jimmy Glotfelty. Kaushik’s announcement of AWS’s goal to deploy 5 GW of small modular reactors by 2030 underscored how digital infrastructure is accelerating demand for reliable, low-carbon power.

“Get the policy right—you don’t need a lot of money. Get it wrong—and you’ll need a lot of money.”

— Jimmy Glotfelty, former Texas PUC Commissioner

Day Two — Global Supply Chains and Market Realities

View the recording here.

Day Two continued the global perspective with sessions led by bp’s Michael Cohen, Shell’s Rick Tallant, and a roundtable of experts from Chevron, KAPSARC, and Energy Intelligence examining the interplay between geopolitics, technology, and oil market dynamics.

Baker Botts Partner Jason Bennett moderated a lively panel on “The Global LNG Market Shuffle,” exploring how shifting trade routes, contract structures, and pricing signals are redefining global gas markets.

Later, Baker Botts Partner Rebecca Seidl-Inglesby and Special Counsel Eric Robinson, Michelle Michot Foss (CES), and Jonathan Smith (GeoFrame Energy), explored supply-chain complexities in mining, metals, and materials — a critical underpinning of the energy transition. Their discussion reinforced the need for government coordination, financing tools, and private-sector innovation to scale responsible critical-materials development.

The final session, “Infrastructure, Reliability, and Resilience in Electricity Markets,” moderated by Baker Botts Partner Michael Yuffee, featured Calpine CEO Thad Hill, Cloverleaf Infrastructure CEO Dave Berry, and Rice University Professor Peter Hartley who emphasized the central role of market design and infrastructure investment in maintaining U.S. grid resilience.

The summit closed with a fireside chat between Ambassador David Satterfield and Baker Botts Managing Partner Danny David, tying together the threads of resilience, geopolitics, and the ongoing evolution of global energy leadership.

Final Takeaway

This year’s summit captured the “radical middle” of energy policy — where ideas meet execution, and where resilience requires both innovation and pragmatism. Across every session, a consistent message emerged: long-term energy security depends on policy stability, supply-chain diversity, and real-world investment discipline.

Baker Botts is proud to work alongside the Baker Institute in advancing that conversation — helping clients navigate the intersection of policy, project development, finance, and technology to build a more resilient energy future.

/Passle/678abaae4818a4de3a652a62/SearchServiceImages/2025-12-09-19-56-21-177-69387ee52b43241fe164114d.jpg)

/Passle/678abaae4818a4de3a652a62/SearchServiceImages/2026-01-29-22-18-36-507-697bdcbc2627876295afb3a5.jpg)

/Passle/678abaae4818a4de3a652a62/SearchServiceImages/2026-01-29-20-29-07-147-697bc313524cbfed07d5c4bd.jpg)

/Passle/678abaae4818a4de3a652a62/MediaLibrary/Images/2026-01-25-20-25-14-453-69767c2a511eaff31e8f94a2.png)